Researches and also statistics reveal that: Youthful drivers often tend to take even more risks included when they are driving. Young vehicle drivers will certainly drive in atmospheres that are taken into consideration to be even more of high risk.

There is no means of recognizing whether the Insurance provider just depend on this data or whether they are privy to more approximately day researches and also data. A Mix of Risk-Taking As Well As Absence of Experience, This is a mix that can substantially affect the price of insurance. It is presumed that by the time a young adult gets to the age of twenty-five they have proceeded into their adult years as well as are no more taken into consideration to be the very same risk-takers that they were before this age.

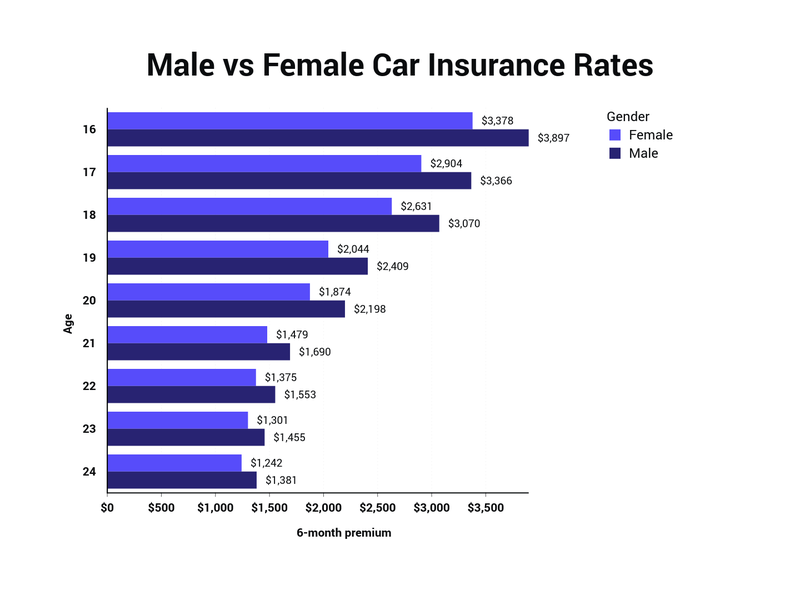

Some might not understand it however frequently automobile insurance coverage is a little cheaper for ladies compared to men. 2 brand-new drivers who coincide age and also have the same conditions however are male and female will generally see that the female's premiums are a little less costly. Just How Much Less Do 25 Years Old Ladies Spend For Vehicle Insurance Coverage? Every Insurer is different but when it concerns premiums for women motorists it is suggested that ladies will pay 5% less than their male counterparts.

The 15-Second Trick For Ask An Agent: Does Turning 25 Affect My Car Insurance ...

All of it regarding their decreasing of threat aspects that might create them to have to pay out claims. It implies that they will thoroughly consider driving information that concerns women after that compare this against the same data accumulated for the males. What they have actually discovered is: Total females do not seem to be included in accidents as commonly as men do, When women do send car claims they get on average lower than those contrasted to me.

Whereas the men tend to speed up a little bit a lot more. Females will obey the website traffic indicators extra carefully, Females were most likely to use their seat belts, Females driving data show that women have less minor web traffic offenses, More males are located to drive without evidence of insurance contrasted to females.

By just how much depends upon which one is suitable. For example, some insurance provider may assume that not using safety belt is a lot more serious than not complying with traffic indicators or the other way around. It is this different perception that creates the distinctions in insurance coverage costs from one company to one more. Historic Information and also The Vehicle driver's Certificate, While the insurance policy business will certainly consider historic statistics worrying female motorists, this is not the only resource they will make use of.

Some Of Guide To Adding Teenager To Car Insurance Policy - Insure.com

If this is information on this for a women driver that puts the Insurer at risk then it will create the premiums to boost just based on those alone. There is no control that a person has over their age when it involves making an application for insurance policy. However, there are numerous other variables that they can regulate.

By the time they get to the age of twenty-five they can do so with a clean driving document that will most likely permit them to delight in less costly insurance policy rates.

The origins of the misconception, So where did the myth that ranks automatically drop at age 25 come from? The idea is based on data that reveals teenager vehicle drivers tend to proportionally obtain right into even more crashes than their older equivalents.

The Best Guide To How Much Will Your Auto Insurance Premium Decrease After 25

However does being 25 actually make a difference versus, say, being 23 or 24? There's no information to suggest that at 25, individuals are instantly much safer drivers. The majority of the data that reveals the 16-24 age bracket is the most reckless is likely being altered by the 16-19 team, considered that these are brand-new drivers simply identifying the road and most likely to make one of the most mistakes.

Rather, insurance companies will factor in a variety of variables that affect claims the kind of automobile you drive (some cars and trucks are more costly to repair), your driving background, and your place (thefts tend to be greater in some areas than others). Age issues, however there's no wonderful 25 price cut, Age, certainly, is constantly a consideration.

If you're hoping to conserve cash on car insurance, it is necessary to first comprehend how your premium is determined, and also just how dramatically these costs can differ. Below are several of the aspects that can affect just how much you pay: Your driving record Your document plays a crucial duty in identifying costs.