Obligation insurance policy will cover the cost of fixing any kind of home damaged by an accident in addition to the medical costs from resulting injuries. The majority of states have a minimum need for the amount of responsibility insurance protection that vehicle drivers have to have. If you can afford it, nonetheless, it is typically a great idea to have liability insurance that is above your state's minimum obligation insurance coverage demand, as it will certainly provide added security in the event you are found to blame for a crash, as you are accountable for any claims that exceed your coverage's ceiling.

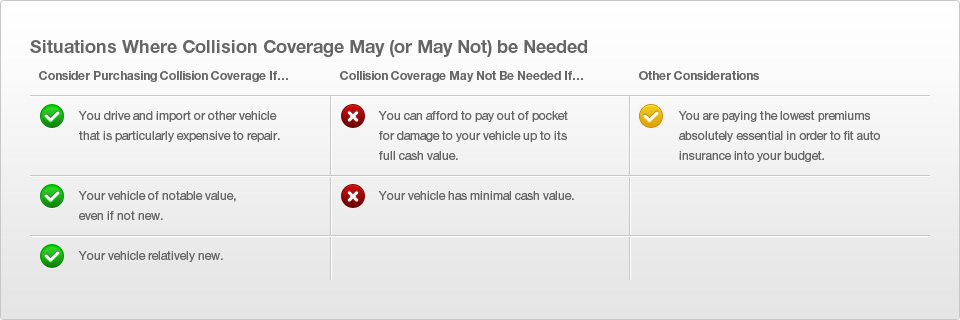

If there is a covered crash, accident coverage will pay for the repair work to your cars and truck. If your auto is amounted to (where the price to repair it goes beyond the value of the vehicle) in a crash, accident coverage will pay the value of your vehicle. If your car is older, it may not be worth lugging accident coverage on it, relying on the value.

Not known Details About Car Insurance Basic Information - The General®

Keep in mind: If you have a lienholder, this coverage is needed. Suppose something occurs to your cars and truck that is unrelated to a covered mishap - climate damages, you struck a deer, your vehicle is taken - will your insurance policy company cover the loss? Obligation insurance coverage and also collision protection cover crashes, but not these situations.

Comprehensive protection is among those points that is fantastic to have if it suits your budget. Anti-theft as well as tracking gadgets on autos can make this coverage somewhat a lot more inexpensive, however carrying this kind of insurance policy can be costly, as well as might not be needed, especially if your auto is quickly exchangeable.

How Collision Insurance - Safeauto can Save You Time, Stress, and Money.

While Comprehensive protection may be something you don't require to acquire, Accident Protection (PIP) is something you should. The prices associated from an accident can promptly include up, as well as in order to cover those costs Accident Defense is available. With this protection, your medical bills along with those of your guests will be paid, regardless of that is at mistake for a crash.

While state legislations mandate that all drivers ought to be guaranteed, this is regrettably not constantly the instance. One more problem that can develop is that while a vehicle driver might have obligation insurance, many states have reasonably reduced minimum protection requirements that might not be adequate to cover all of the expenses of an accident.

Automobile Insurance - Minnesota Department Of Public Safety Things To Know Before You Buy

This is the type of situation where Uninsured and also Underinsured Driver Security would certainly aid with expenses. Conserving idea: It's generally relatively cost-effective to add uninsured/underinsured driver security to your car insurance plan, particularly considering the amount of protection it supplies.

Coverage may not be offered in all jurisdictions and is subject to underwriting review as well as approval.

The Best Guide To Collision Insurance: Everything You Need To Know - Getjerry ...

If you accumulate from your very own insurance firm, your firm takes over your right to file a damage claim against the other motorist's insurance. For instance, say you remain in a vehicle mishap with Joseph Blau, who is guaranteed by the Incidental Insurer. You are wounded in the accident, and also your automobile receives $3,000 worth of damages.

If you do not intend to wait to earn money by Incidental, or if you aren't sure Subordinate is going to concur that Joseph was at mistake and think it may not pay the full $3,000, you can submit a case with New Age. Accident insurance coverage pays despite fault, so New Age should pay you the complete $3,000 minus any type of deductible.

The Main Principles Of New Jersey's Basic Auto Insurance Policy

You are additionally totally free to gather whatever home damages your own collision protection did not spend for, such as your insurance deductible (see listed below) and damage to any kind of uncovered devices or residential property. Benefits of Utilizing Your Accident Protection There are 2 main advantages to claiming residential property damage under the collision insurance coverage of your own plan as opposed to in a third-party claim.

This is since crash protection pays despite mistake. A third-party insurance claim is paid just if the various other event's mistake is revealed, and that commonly takes a while if the other insurer challenges the degree to which its insured was accountable for the accident. You might have to wait for an authorities mishap report or to get in touch with a witness before you can fully demonstrate the other driver's fault.

The Best Guide To Automobile Coverage Information - Ct.gov

Second, if you also have a third-party injury claim, you simply might not wish to talk with the various other driver's auto insurance provider up until you have actually completely investigated the matter. Till you are particular regarding the realities and also your disagreements, it is unsafe to go over details of the crash with anybody on the "opposite side".