The catch is that the limitation for loss outside the home is generally 10% of the complete personal residential or commercial property restriction. So, if you have $2,500 in coverage, you'll only be reimbursed approximately $250 for products swiped from your cars and truck. That still beats what your car insurance firm would certainly pay: nothing.

He includes that ALE insurance coverage could likewise cover expenses connected with moving needs to the apartment or condo not be habitable for an extended duration. These policies usually repay you for the difference between your ALE's and also your typical living costs - insurance. Individual responsibility protection, Personal obligation insurance policy for tenants covers the damages you cause to other individuals as well as their property.

Experts recommend a minimum of $300,000 in obligation insurance coverage. If you have many possessions, you might intend to buy an additional umbrella plan of at the very least $1 million. It is essential to tension that liability coverage protects you for problems you create to others or their residential or commercial property. apartment insurance. It does not cover your residential or commercial property.

renter cheapest renters insurance coverage apartment insurance insure

renter cheapest renters insurance coverage apartment insurance insure

, vice president of home, personal insurance property at Travelers. "This way, expenses can be paid without an obligation case being filed against the occupant.

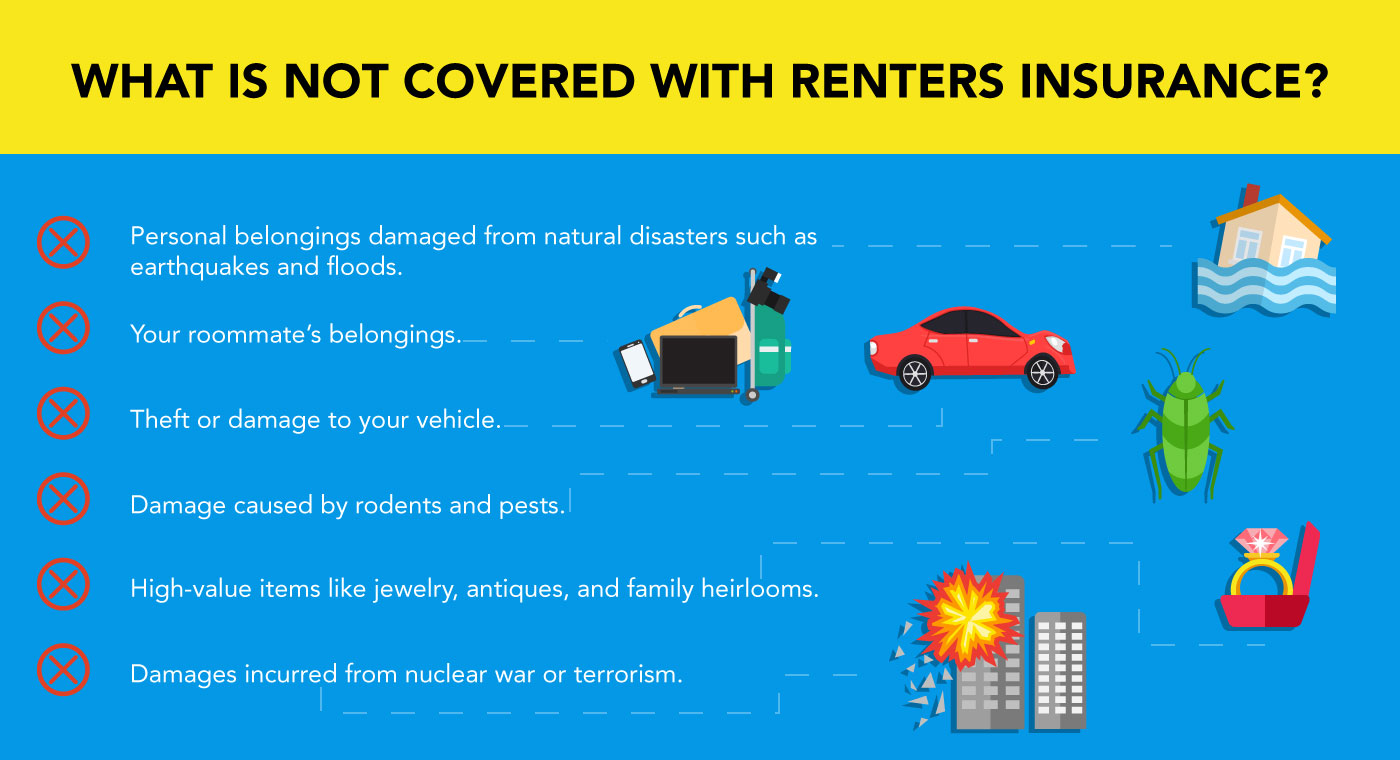

Once again, this medical insurance coverage applies to the treatments of others, not on your own. Other considerations, It's essential to keep in mind that rental insurance coverage never covers flooding or earthquake damage.

How Does Renters Insurance Work? - Nationnorth Insurance - Questions

Or, you can purchase a different quake policy. What does occupants insurance coverage not cover? Does a renters insurance plan cover earthquakes? Will it cover me if my pit bull attacks a person? Possibly not. There are a lot of points occupants insurance will not cover. The majority of these items usually aren't covered by a typical policy, however you can often purchase an endorsement to make certain they are covered.

Or else, you'll be reimbursed only for the depreciated "real cost worth"-- what that 10-year-old, pre-owned natural leather coat would have brought on the marketplace today. Back lease (liability). You will not be compensated for any type of rent you might owe the landlord. It is also crucial to bear in mind that damages are not covered till you pay your deductible.

affordable insurance apartment insurance renters insurance insurance rental

affordable insurance apartment insurance renters insurance insurance rental

If you pick a $1,000 deductible as well as you endure insured problems of $2,000, you will certainly get on the hook expense to pay the $1,000 prior to your insurance coverage begins. Why would you take a greater deductible? Because doing so reduces your premium costs. If you go for an extensive period without making an insurance claim, you can conserve a lot of money total by raising your insurance deductible and also decreasing your premium expenses. discount.

If a guest gets wounded on your property and also you're found responsible, as well as you're sued for damages of $150,000, as well as you just have $100,000 in personal responsibility occupants insurance, you would certainly have to pay $50,000 out of pocket. If you do not have the cash, your incomes, financial savings or other possessions may be required to pay the distinction.

But they supply the satisfaction that your possessions will be replaced. Real cash money value: With this kind of coverage, insurers take depreciation right into account when determining the value of your ownerships. Your insurance company will only pay out the equivalent of the valuables' value at the time of the loss.

The Basic Principles Of How Does Business Renters Insurance Work?

Most of the times, it will certainly not be enough to cover the expense of a brand-new TV.These policies are more economical, but keep in mind that you will have to cover the distinction in between your plan pays and also the expense to change your properties with new ones - bundle. Whether you purchase replacement or actual cash money value insurance coverage, it is very important to note that protection may be topped on some very costly items.

Sometimes they're your fault. Often they just come at you. Occupants insurance coverage is just like home owners insurance policy. It spends for your personal building that's harmed or stolen. And it supplies liability defense for any kind of damages or injuries created by you, your household member of the family or your family pets, either in or outside the house.

It varies from homeowners insurance coverage in that it does not cover structural damage. This is also why it's much less expensive."Everything that you brought right into the framework is your duty," claims Mike Barry of the Insurance Policy Info Institute (III). "The property owner's obligation, when it concerns insurance policy, is restricted primarily to the framework."Just how much does renters insurance policy price? Just how much does a renters plan cost monthly for an apartment? Surprisingly, very little it's much less than $30 a month, Fees differ based on protection amounts, the tenant's credit rating, and also where she or he lives - option.

These recommendations usually include a few bucks monthly. Obviously, there are methods to trim those prices. For example, increasing your deductible can minimize your premium prices. An insurance policy provider also may charge you less if you have an existing connection and have actually acquired various other insurance policy from the company such as car insurance policy.

The III additionally notes that you might certify for discounts that several insurance companies offer - cheaper. These include having: A safety system in your service, Smoke alarm and deadbolt locks in the leasing, A great credit scores score, Ultimately, if you are older than 55, some insurance providers will supply you a break on your premium.

The smart Trick of How Does Renter's Insurance Work? That Nobody is Talking About

Enter your state in the search area to obtain your results. Rates are for common insurance coverage levels of $20,000, $40,000 and also $60,000 in personal effects protection, with responsibility limits of $100,000 and $300,000, all with a $1,000 deductible. Just how much occupants insurance coverage do I require? The solution can be complicated and varies from one person to another.

If you have a lot of properties, you'll probably want sufficient liability insurance coverage to protect them in case you are sued. Numerous insurers offer policies with obligation protection as reduced as $100,000. Nevertheless, the III notes that some professionals urge renters to purchase at the very least $300,000 worth of defense and also more for occupants with several properties to protect. cheapest renters insurance.

Some business market policies for as little as $50 a year with a multiple-policy discount rate, however they supply reduced clinical limitations. Your present car insurance policy provider is an excellent area to begin, as most of them likewise sell policies for tenants as well as use some kind of a packing price cut.

Nevertheless, typically, Insurance coverage. damages. com found the following companies were amongst the least expensive significant service providers running nationwide, of those checked: Nationwide, State Ranch, Travelers, Allstate, Farmers, How to get an occupants insurance coverage, The outright best means to save cash on your renter's insurance is to shop your plan a minimum of every three years.

affordable insurance credit renters coverage water damage

affordable insurance credit renters coverage water damage

To do so, you require to compare renters insurance policy prices estimate. It is very important that you are contrasting apples to apples when shopping policies. Here are a couple of things to check if you are seeking exactly how to obtain renters insurance coverageAll occupant policies have protection degrees for both personal residential property and liability coverage.

5 Reasons Why You Need Renters Insurance - Mcgriff Fundamentals Explained

A policy that caps responsibility protection at $100,000 will probably be less costly than a policy offering $300,000 of coverage (affordable). You can still wind up on the hook for some significant expenses if someone is seriously harmed in your home and also their expenditures swiftly exceed $100,000. Renters insurer, When it concerns purchasing for a policy, you have no scarcity of alternatives and also it will be simple to obtain a tenants insurance coverage quote.

Often asked inquiries concerning tenants insurance, Should I share a renters policy with my roommate? Many experts do not recommend sharing occupants insurance policy with roommates.

All of your flatmate's claims will certainly finish up on your insurance coverage document, and if your roomie's properties have a greater worth than yours, a 50/50 split on the bill might not be fair. Occupants insurance for college students, Mostly all house owners plans will prolong insurance coverage to university pupils residing in a dormitory or university housing."The majority of homeowners plans include protection for an university trainee's personal possessions while they are residing on campus.

affordable coverage cheap renters insurance cheaper affordable renters insurance credit

affordable coverage cheap renters insurance cheaper affordable renters insurance credit

The plan reimburses you for damage to your ownerships, while the property manager's plan will certainly compensate damages to the rental itself. Does occupants insurance cover earthquakes? A home owners or renters plan typically does not cover you from quake damages. Quake insurance coverage can usually be included as a biker to your renters insurance coverage plan. bundle.

Does tenants insurance policy cover burglary? Yes, tenants insurance policy cover theft so, if you lost your individual items you can ask for insurance claim. If you wish to know even more about just how does tenants insurance coverage functions in case of theft for different situations check out our detailed guide to exactly how does renters insurance covers burglary.

Some Known Questions About How Does Renters' Insurance Work? - Blog.

Just list your most useful belongings as well as just how much it would certainly set you back to change them - cheap renters insurance.

If you're like the majority of, the solution is most likely never (water damage)., isn't the sexiest of topics. It's that thing you have in situation something poor takes place, or that you maintain putting off getting also though you recognize you should not.

We're talkin' concerning those oaf or bad-luck minutes that can happen at a coffeehouse, songs event, home party, or also on a vacation. As well as that's underrated. Prior to we dive right into this, let's do a fast refresher. Renters insurance is there to compensate you if something bad takes place to you or your stuff (read: phone, laptop, watch, bike, etc) minus your insurance deductible, naturally.

It additionally covers momentary living expenses if your location becomes uninhabitable due to one of those negative points provided above, and also certain medical/legal fees for others if you're liable. In what real-life circumstances can occupants insurance in fact come to the rescue? In this day as well as age, it's pretty uncommon to leave the home without a phone.

Naturally, some of the most common Q's we're asked at Lemonade are: as well as, Does tenants insurance cover theft outside the residence? Our solution? It sure does! Check over here As well as fortunately, occupants insurance coverage does not just cover your things at residence it has your back when you're on-the-go. So if your phone is stolen at a songs event, or on your commute home from work, occupants insurance coverage can repay you.

Facts About Aarp® Renters Insurance Quote - The Hartford Revealed

Ouch. He heads over to the hospital, obtains his clinical bills, and also chooses to sue you. Dual oops. Thankfully, occupants insurance can cover the expenses to obtain you out of this jam. Your personal responsibility coverage will certainly start, and spend for both his clinical and also your legal charges. Dilemma, prevented! Dripping pipes is among those points you never ever think will certainly happen, up until it does.

If you ever before have that sinking feeling understanding this happens, and your stuff is damaged, renters insurance coverage has your back. property management. When this takes place, you might be wondering, 'does occupants insurance cover carpet damages? You can rest simple, understanding your things is covered.